- June 2, 2020

- COVID-19, Perspectives

When Your Crystal Ball Gets Cloudy: Creating Reliable Forecasts in Uncertain Times

Jessica Rossi, AICP

Senior Economist and Planner

Sound market forecasts are imperative to support sustainable decision-making. This is particularly true for the AEC industry, which is influential in shaping how our communities grow and evolve. Kimley-Horn’s Jessica Rossi, AICP, who specializes in identifying and quantifying market opportunities for real estate developments and acquisitions, forecasting land demand for long-range planning initiatives, and conducting cost/benefit analyses for local governments, explains how to best create reliable forecasts during times of economic uncertainty.

An Interview with Jessica Rossi

You have a unique role at Kimley-Horn. Describe what you do and how you interact with teams across the firm.

Jessica Rossi (JR): I lead a team that provides real estate and economic development consulting to a broad spectrum of public, private, and nonprofit clients throughout the country. My experience working with both public- and private-sector interests results in a balanced approach to projects, combining market economics with long-range goals and infrastructure needs.

Understanding growth dynamics and creating reliable forecasts are some of the most important parts of my job. Forecasts influence nearly every project Kimley-Horn works on. Whether it’s projecting how large a city will be in five, 10, or 20 years, estimating traffic increases for a new retailer, or leveraging bicycle and pedestrian forecasts to design intuitive crossings for a greenway, forecasts are the foundation of our approach and inform the results of projects.

Forecasting future growth and development can be challenging in any economic environment. What are the challenges with forecasting in times of rapid change or major disruptions?

JR: It’s no secret that we are living in unprecedented times. We are reminded of this daily by the direct impacts to our personal and work lives, constant media coverage, and emails that almost always begin with “Hope you’re doing well in these unprecedented times.” At this level of disruption, it’s inevitable that predicting the future will be challenging. If we don’t know what tomorrow will bring, how will we understand next month or next year? Our proverbial crystal ball is cloudy.

Forecasting methodologies vary widely, but all include some measure of looking to the past to understand trends. Creating forecasts in times of rapid change is challenging because we don’t know the scale or length of the disruption. This is particularly relevant during the COVID-19 pandemic. Economics isn’t the sole factor at play, far from it. Recovery will be influenced by local decisions to reopen the economy, personal choice as it relates to health and safety, and the pace at which we develop medical responses. This disruption will have widely varying impacts based on geography and real estate sector.

And, to put the cherry on top, 2020 is a Census year. Our socioeconomic base data is as old as it gets. It’s time for a refresh and the process is in the early stages of collection. The new Census data won’t be available until next year.

The current economic disruption will influence real estate sectors in different ways. Will this impact Kimley-Horn’s ability to create reliable forecasts?

JR: In short, no. Despite the challenges, projects need to move forward. Our clients don’t have the luxury of waiting until life returns to normal. While it is certain that COVID-19 will have an impact, it is unlikely to permanently cloud longer-term trends that have been established. In fact, there’s a lot we can learn and apply from the past.

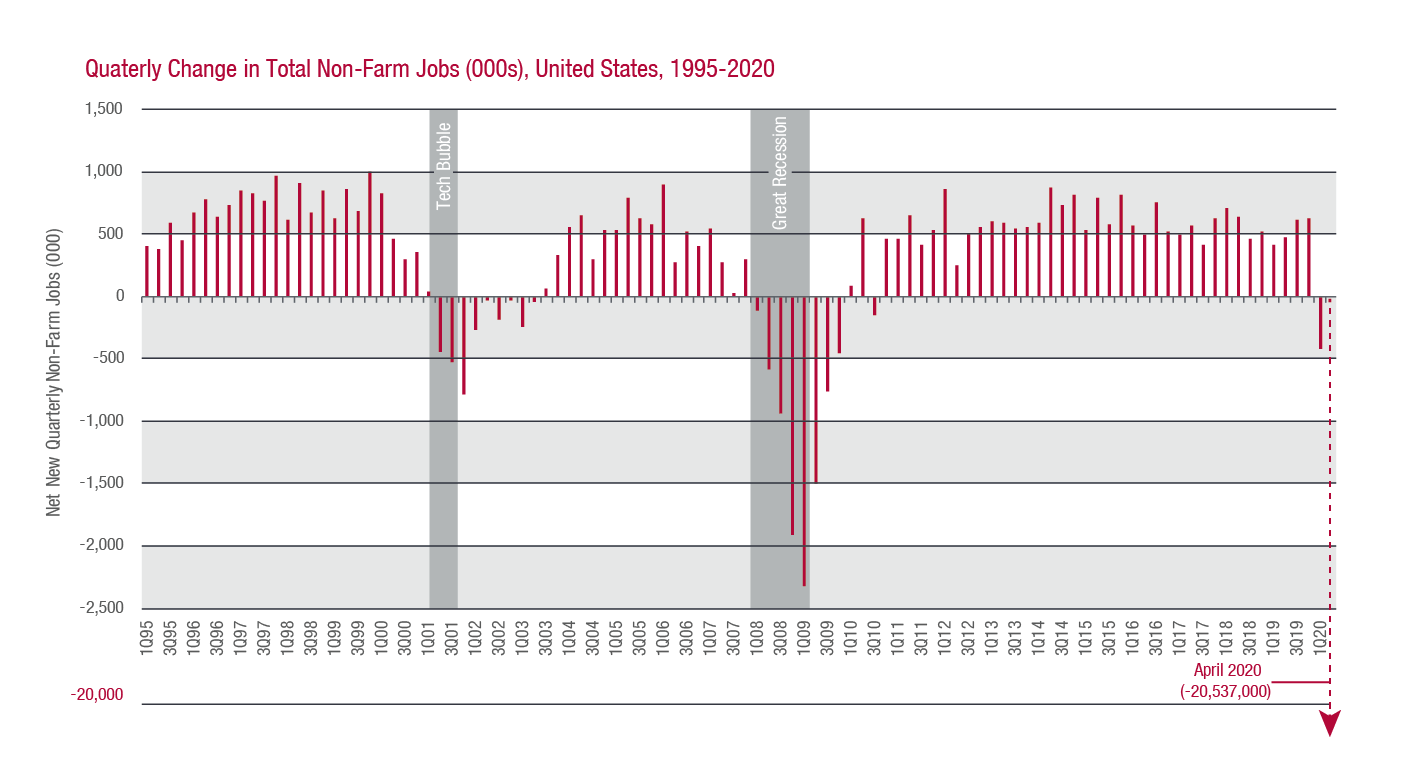

There is little doubt that we are heading toward a recession in the United States. The real question for future forecasting is what the recovery scenario will look like. The following graph demonstrates quarter-over-quarter net job growth since 1995 and the impacts in both 2001 (9/11 and the dot-com bubble) and 2007-2009 (The Great Recession and housing crisis). Understanding how our economy has rebounded in previous downturns can give us valuable perspective to create reliable forecasts moving forward.

It’s important to note that while there are lessons to be learned from the past, it’s not foolproof. There are a lot of dynamics at play. Some sectors, retail as a leading example, have been undergoing fundamental changes leading up to COVID-19. Looking to previous downturns will likely not provide much relief in these cases.

Speaking of retail, this sector was already undergoing shifts in how goods are bought and sold. What does your crystal ball say about the future of this sector?

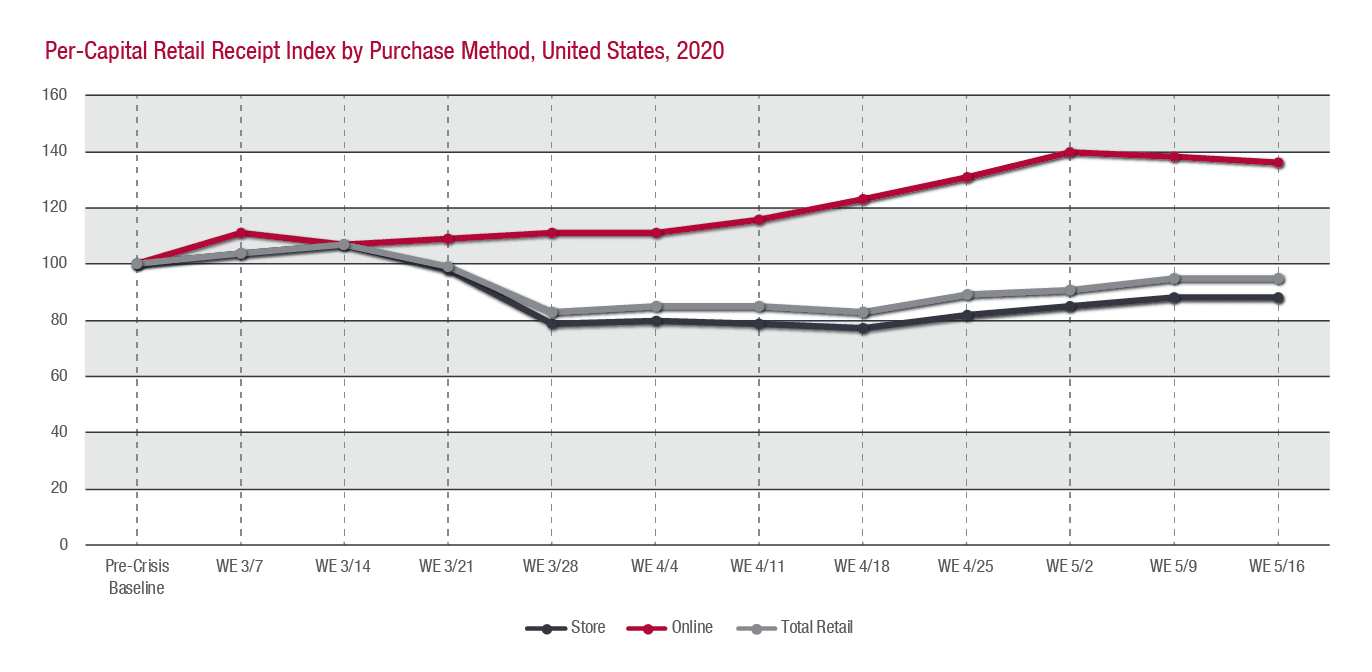

JR: If I could clearly see the future on retail, I would be a regular on the evening news circuit. It isn’t disputed that consumer preferences have been shifting. COVID-19 has amplified trends that were already impacting retail, particularly as it relates to the influence of online shopping. As you can see from the graph below, online shopping has increased rapidly since the beginning of March. I am confident that as local economies reopen, brick and mortar sales will rebound. We can already see that in retail receipt indexes. At the same time, online retailers will be positioning to sustain their newfound capture.

Our clients, public and private, are trying to keep their projects moving forward. What are some best practices for creating forecasts that are dependable?

JR: I encourage forecasting creation that is as unique as the communities and projects it supports. Here are my tips for creating transparent and reliable forecasts in uncertain times.

- Use the best data available. Our forecasts are only as good as the data that influences them. Or, as I sometimes like to say, “Garbage in. Garbage out.” Now is not the time to use old datasets or questionable sources. To the extent possible, consider reviewing multiple datasets to determine the best fit for your project.

- Incorporate local nuances. Talk to your clients. Host an extra stakeholder interview. Seek local expertise. Incorporating local feedback will help refine third-party datasets that typically lack this level of detail, resulting in a more “bottom-up” approach that considers existing supply pipeline, land availability, policy decisions, and appetite for development.

- Look to the past. Instead of pulling five-year trends, look farther. How did the community and region you’re working in weather previous storms? Is the local economy grounded in sectors like education and medical, which tend to be more resistant to recessionary impacts, or is it more tourism-centric, which could have a longer road to recovery?

- Provide ranges. Consider offering low, medium, and high growth scenarios. When possible, using ranges gives the variability needed during uncertain times.

- Revisit, review, revise. Forecasts aren’t meant to be set in stone or collect dust. Regularly revisit forecasting efforts to confirm applicability. This is particularly important for those created during economic slowdowns.

Forecasting is still possible during times of uncertainty; it simply requires some additional elbow grease to make sure that we are providing a reliable view of the future.

About the Expert

Jessica Rossi, AICP

Jessica works on a wide variety of visioning and economic development assignments for local governments and regional agencies. Additionally, developer and investor clients rely on Jessica’s insight to determine demand for commercial and residential projects and to choose specific concepts to maximize economic development, marketability, and value. Her experience working with public- and private-sector interests is useful in creating innovative solutions to complex issues. As a national resource for the firm, Jessica’s leadership has guided high-quality and innovative planning strategies that are grounded in a market reality.